LLM-powered micro quant workflows for gold, FX, and index strategies.

MicroQuant by Lazying.art pairs market microstructure data with reasoning models to synthesize signals, stress test them, and execute with risk-aware controls. It is a Micro Quant App built for fast experimentation and production deployment.

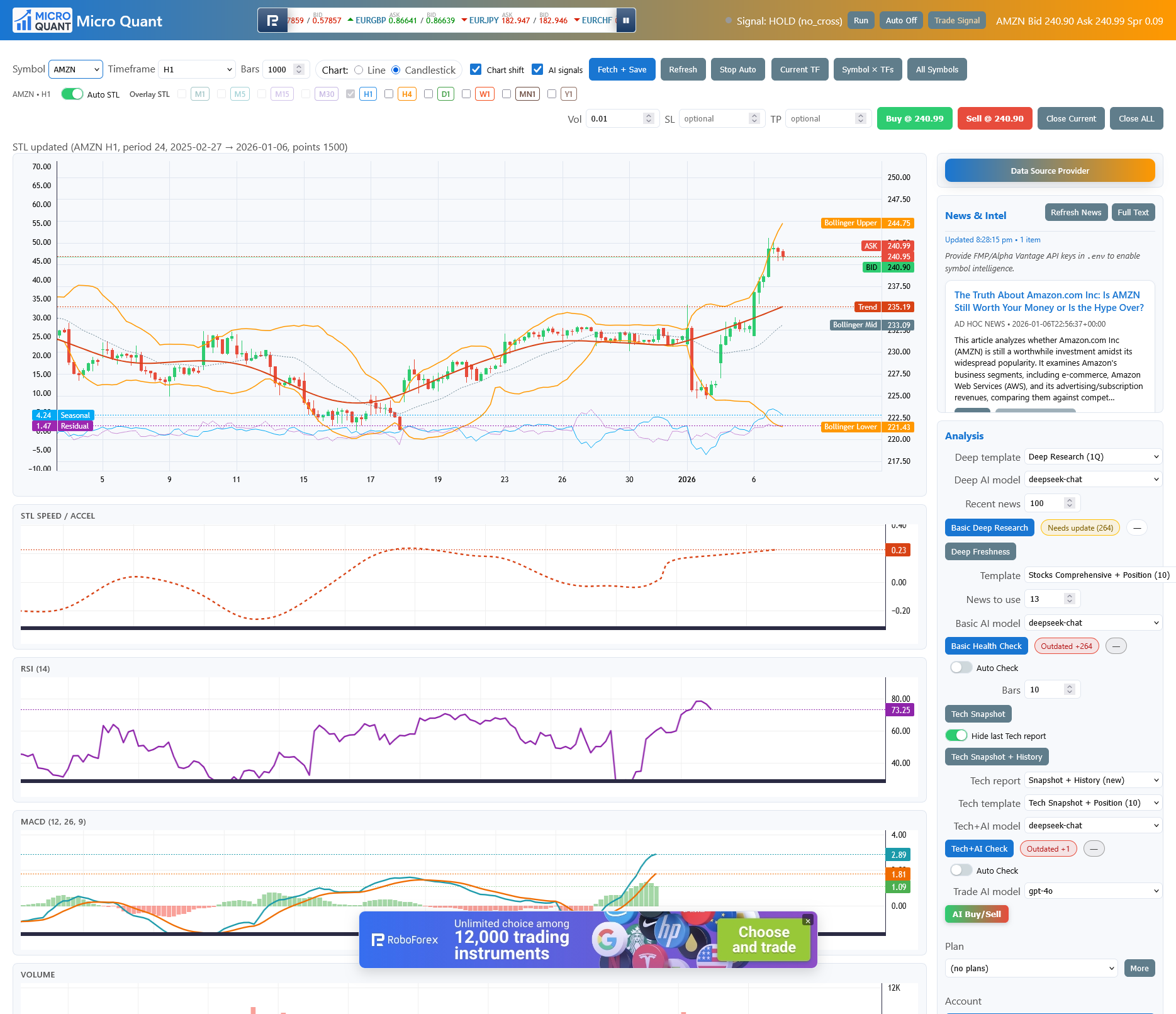

Live signal snapshot

Micro Quant App view

A compact, operator-first interface for strategy design, LLM commentary, and execution readiness. Track hypothesis, backtest results, and real-time signal confidence on one screen.

LLM-driven trading loop

The system routes market context through a structured reasoning stack. Every action is logged, audited, and paired with a quantitative guardrail before execution.

Sense

Ingest multi-timeframe OHLC, volume profiles, macro releases, and sentiment.

Think

LLM generates scenario trees, risk-adjusted hypotheses, and promptable notes.

Act

Signals are scored, filtered by risk engine, and routed to MT5 execution.

Build a structured prompt from market snapshots and news.

Generate trade plans with confidence bands and trade triggers.

Filter with regime checks, variance caps, and exposure limits.

Route to MT5 and monitor PnL with automated stop logic.

Data, research, and deployment stack

Built to move from research notebook to live execution with a minimal operational footprint. Everything is modular, and the LLM layer is swappable.

Data & storage

Postgres OHLC store, feature snapshots, and prompt artifacts for traceability.

Modeling

LLM analysis, lightweight ML filters, and regime classification modules.

Execution

MT5 terminal bridge, risk controls, and alerting across channels.

Build the next Micro Quant release

MicroQuant by Lazying.art is in active development. Join the early access group to shape the LLM tooling and the gold strategy research pipeline.